Tesla

Tesla Model 3 Long Range (AWD) becomes eligible for $7,500 EV tax credit

Tesla Model 3 Long Range All Wheel Drive (AWD) is now $7,500 Federal Tax credit eligible at the point of sale confirms the US Department of Energy and numerous user reports.

Fueleconomy.gov website updated the list of eligible EVs on June 17 (today) and added the Tesla Model 3 Long Range All Wheel Drive (2024) for a $7,500 Federal tax credit with a $55,000 ceiling.

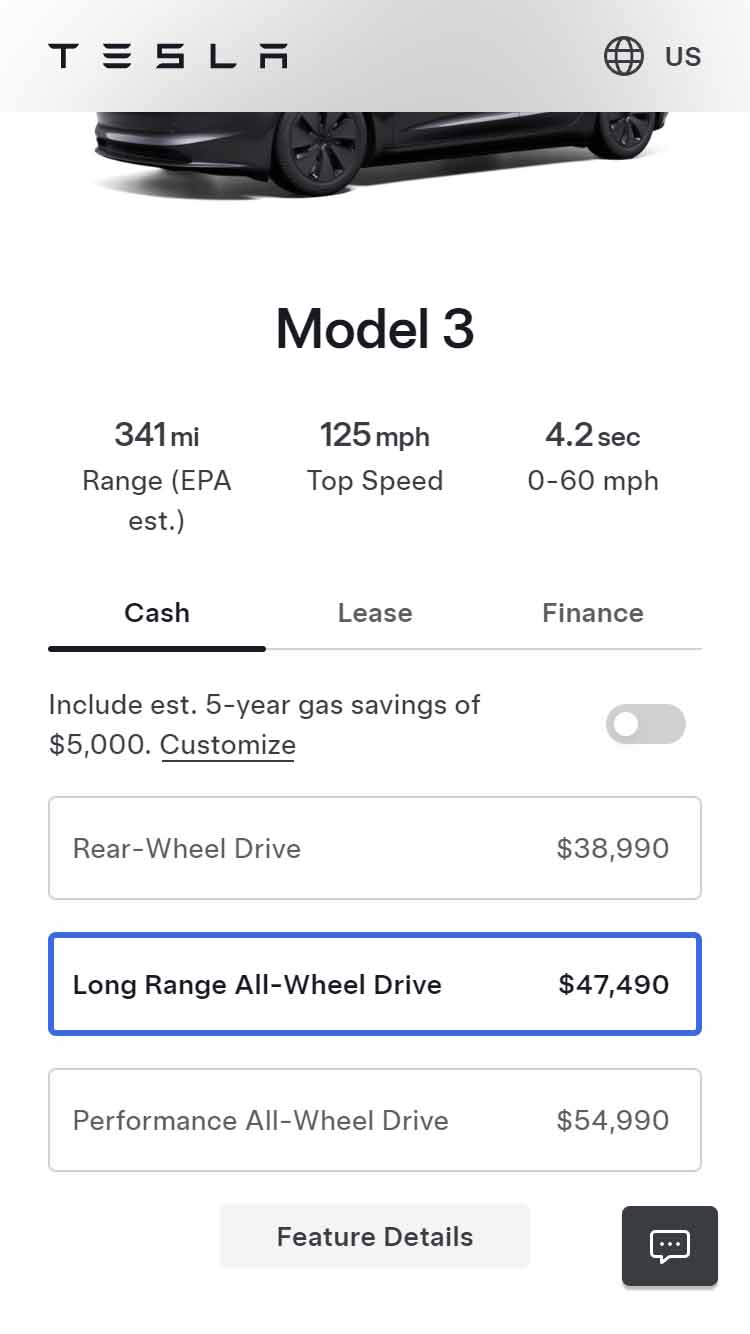

Notice that Tesla has reduced the $250 from the Long Range model to $47,490 from $47,740. However, the company has not updated the new tax eligibility on the official Tesla website configurator at the time of writing this article.

Update: Tesla has officially announced this news via social media site X.

Tesla Model 3 Long Range All Wheel Drive (AWD) Listed as $7,500 Federal Tax Credit eligible (Source – Fueleconomy.gov )

Earlier this year, Model 3 Rear Wheel Drive (RWD) and Long Range lost eligibility after new guidelines on EV battery sourcing from China. The Model 3 and Model Y are the most popular EVs and account for most of Tesla’s annual sales.

Therefore, the company may have changed the supply chain and regained eligibility with batteries sourced from South Korea. This component has been used for the Model 3 Performance 2024 revealed in April this year for the full tax credit.

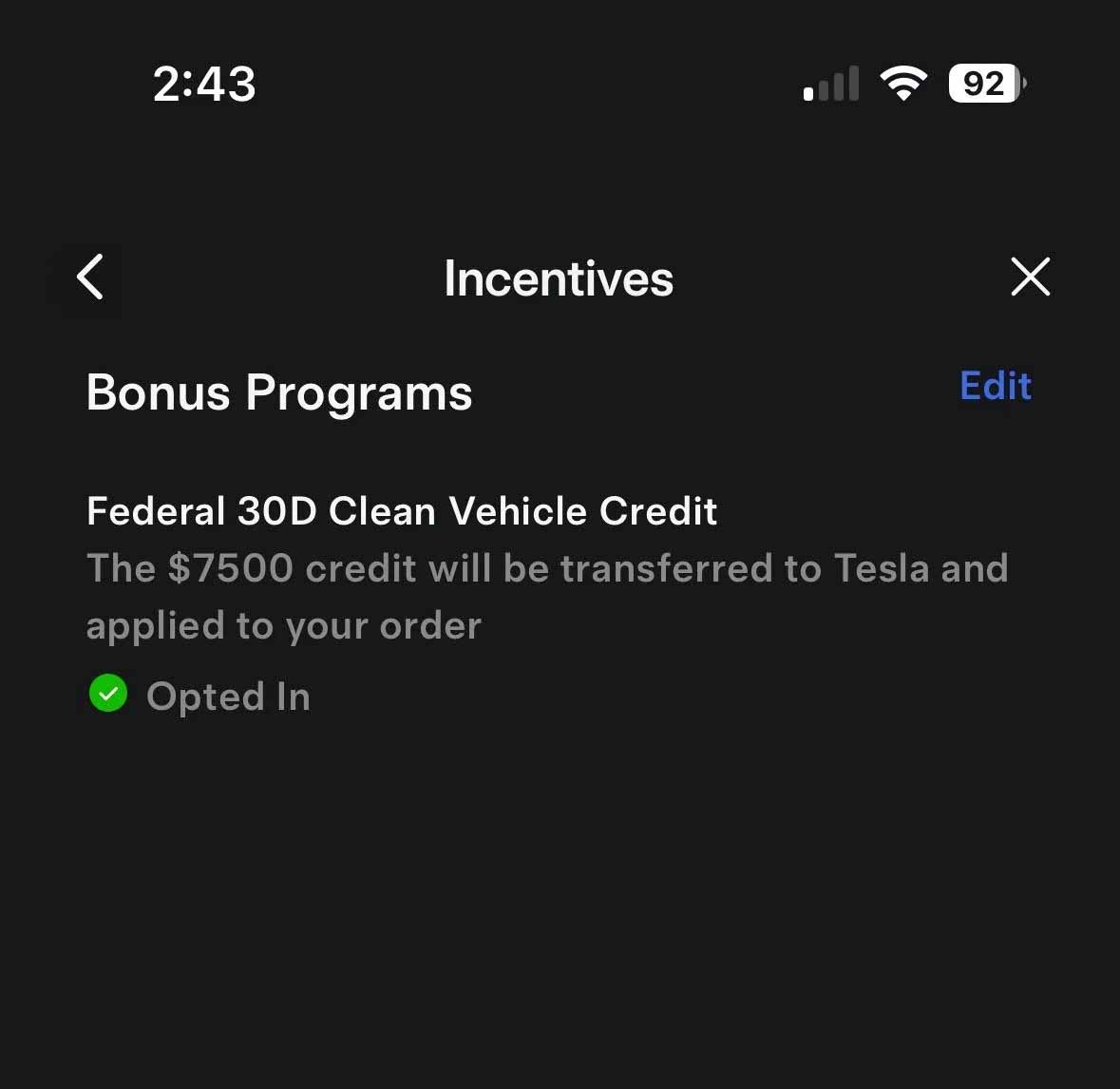

This confirmation comes amid Tesla customers shared screenshots of “Bonu Programs” including Federal 30D clean vehicle credit of $7,500 for Long Range model. This particular tab has appeared for customers whose orders are pending.

“You have successfully provided the information necessary for enrollment in incentives,” says a screenshot posted on Reddit this week (via Insideevs).

Tesla Model 3 Long Range $7,500 Tax credit incentive screenshot (source – @ravaram/Reddit)

If so, the Long Range’s price with the $250 cut will take it below $40,000 and stand beside the RWD model with only a few hundred dollars difference.

The Model 3 RWD will be the only model in the lineup without tax eligibility, which may also change after equipping the new battery pack. Meanwhile, Tesla has not officially announced the tax credit eligibility on its website and social media platform.

Upgrade Tesla Model 3 Price as of June 16, 2024 (Source – Tesla)